Get This Report about Nj Cash Buyers

Table of ContentsSome Known Facts About Nj Cash Buyers.Getting My Nj Cash Buyers To WorkHow Nj Cash Buyers can Save You Time, Stress, and Money.Getting My Nj Cash Buyers To Work

Many states grant customers a particular level of defense from financial institutions regarding their home. Some states, such as Florida, totally exempt the house from the reach of certain lenders. Other states set restrictions varying from as low as $5,000 to as much as $550,000. "That suggests, regardless of the value of your home, lenders can not require its sale to please their insurance claims," states Semrad.If you fall short to pay your home, state, or government tax obligations, you might lose your home through a tax lien. Acquiring a home is much less complicated with money.

(https://www.openlearning.com/u/njcashbuyers-smm1bi/about/)I know that many vendors are much more likely to approve a deal of cash, however the vendor will get the money regardless of whether it is funded or all-cash.

Not known Details About Nj Cash Buyers

Today, about 30% of United States buyers pay money for their residential or commercial properties. There might be some good reasons not to pay cash.

You may have certifications for an exceptional mortgage. According to a recent research by Cash magazine, Generation X and millennials are considered to be populations with the most possible for development as customers. Taking on a bit of debt, especially for tax obligation functions great terms could be a far better option for your funds on the whole.

Perhaps purchasing the securities market, common funds or an individual business may be a much better alternative for you in the lengthy run. By buying a residential property with cash, you take the chance of diminishing your book funds, leaving you susceptible to unanticipated upkeep expenditures. Owning a residential property involves continuous costs, and without a home loan pillow, unanticipated repair work or renovations can stress your funds and hinder your capacity to maintain the property's condition.

Nj Cash Buyers - An Overview

Home costs increase and fall with the economic climate so unless you're intending on hanging onto your home for 10 to 30 years, you might be far better off spending that cash money in other places. Investing in a home with money can accelerate the acquiring procedure dramatically. Without the requirement for a home mortgage approval and associated documentation, the transaction can shut faster, offering an affordable edge in affordable property markets where vendors might choose cash purchasers.

This can result in significant price financial savings over the long term, as you will not be paying passion on the lending amount. Cash money purchasers commonly have stronger settlement power when handling sellers. A cash offer is more attractive to sellers considering that it decreases the risk of an offer failing because of mortgage-related problems.

Keep in mind, there is no one-size-fits-all service; it's important to customize your decision based on your private scenarios and lasting goals. Ready to get going checking out homes? Provide me a telephone call anytime.

Whether you're liquidating properties for an investment residential or commercial property or are carefully conserving to purchase your desire abode, getting a home in all money can significantly boost your acquiring power. It's a critical step that reinforces your setting as a purchaser and enhances your flexibility in the realty market. Nevertheless, it can put you in a financially susceptible spot (cash for homes companies).

Our Nj Cash Buyers Ideas

Conserving on rate of interest is one of one of the most common factors to purchase a home in cash money. Throughout a 30-year home mortgage, you might pay 10s of thousands and even thousands of thousands of dollars in overall interest. Furthermore, your getting power boosts without funding backups, you can explore a broader option of homes.

The biggest danger of paying cash for a house is that it can make your financial resources unpredictable. Tying up your liquid assets in a property can lower economic flexibility and make it more tough to cover unforeseen expenditures. Additionally, connecting up your money indicates losing out on high-earning investment opportunities that could produce greater returns somewhere else.

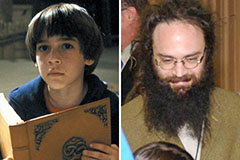

Shaun Weiss Then & Now!

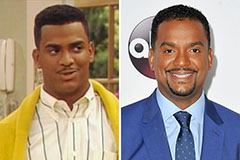

Shaun Weiss Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!